The Small Business Reorganization Act was designed to make Chapter 11 reorganizations more accessible to both small businesses and individuals with business debt. Subchapter V was added to Chapter 11 of the Bankruptcy Code so that qualifying debtors could avoid some of the costs of a traditional Chapter 11 and exit bankruptcy quicker and more efficiently.

Below are some of the basic differences and commonalities between Subchapter V and traditional Chapter 11, followed by the eligibility requirements to file a Subchapter V bankruptcy case (which is being watched closely given the lapse of the increased debt limit—more on that below), and the Subchapter V plan process.

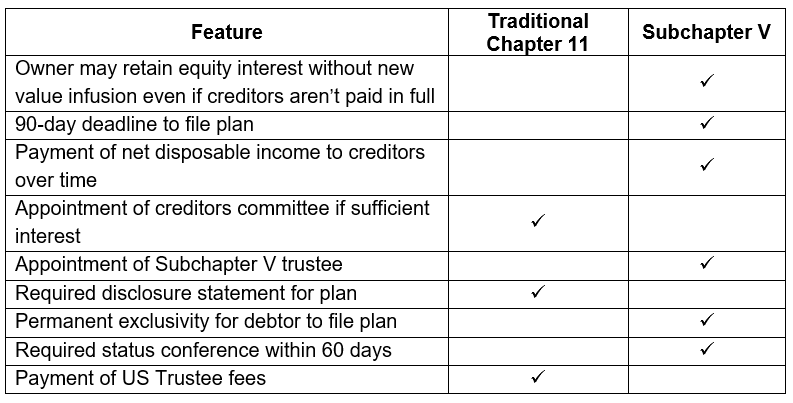

Differences Between Traditional Chapter 11 and Subchapter V Cases

Subchapter V retains many of the features of traditional Chapter 11 cases, but it also differs in several ways, including:

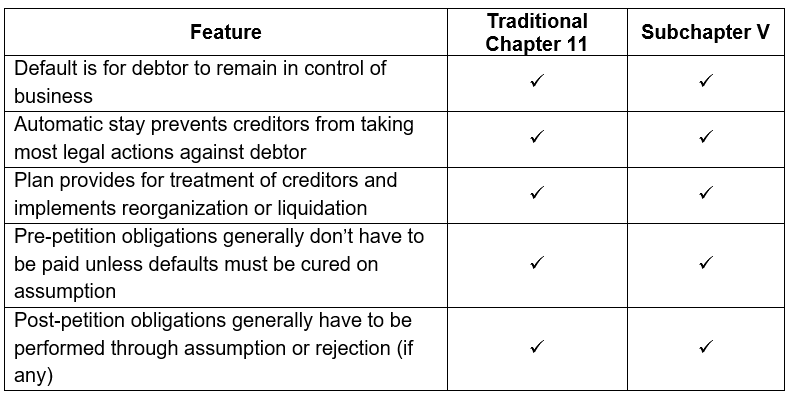

Commonalities Between Traditional Chapter 11 and Subchapter V Cases

The following aspects of traditional Chapter 11 cases, among others, also apply in cases under Subchapter V:

Eligibility for Subchapter V Bankruptcy Filing

Under the initial eligibility rules of Subchapter V, a small business debtor was required to be an entity “engaged in commercial or business activities” that generated 50 percent or more of its debt from those activities, with total noncontingent, liquidated debt (secured, unsecured, or both) of no more than $2,725,625 owed to nonaffiliates or noninsiders.

Almost immediately after Subchapter V became effective, Congress passed the CARES Act in March 2020 under which the debt limit for Subchapter V eligibility was increased to $7.5 million owed to nonaffiliates or noninsiders through March 2021. This higher debt limit was extended several times but, despite the substantial use of Subchapter V and broad expectations the debt limit would be extended, it expired in June 2024 and hasn’t been adjusted since. As of the publication of this alert, the current debt limit is $3,024,725—the initial threshold adjusted for inflation—which has cut off the use of Subchapter V for many small businesses and individuals.

Retaining Equity and Paying Creditors in Subchapter V

In a traditional Chapter 11 case, the “absolute priority rule” requires creditors to be treated in accordance with their priorities. Secured creditors must be satisfied first (to the extent of the value of their collateral), followed in sequence by administrative claims (i.e., those arising during the case), priority unsecured claims, general unsecured claims (e.g., pre-bankruptcy and rejection damages claims), and, finally, equity interests. Generally speaking, each class of creditors must be satisfied in full before the next class can receive anything. For a small business owner that wants to retain its equity, the absolute priority rule may be problematic.

Subchapter V offers an alternative, as the absolute priority rule does not apply. This means current equity owners may retain their ownership interests even without creditors being paid in full. To accomplish that, though, the plan needs to be consensual—with creditors accepting the plan—otherwise the debtor’s “projected disposable income” must be paid over the life of the plan, which can range from three to five years, regardless of what return that may provide to creditors. To meet the “fair and equitable” test dictated by the Bankruptcy Code, the debtor must show a reasonable likelihood it will be able to make the projected plan payments and that appropriate remedies are available to protect claim holders in the event payments aren’t made. Since Subchapter V plan payments may be entirely dependent on the debtor’s performance, it is especially important to track them closely.

No Disclosure Statement Required for Subchapter V Plan

Traditional Chapter 11 debtors must file a disclosure statement, which describes the debtor’s assets, liabilities, history, capital structure, business affairs, and proposed plan and enables creditors to make an informed decision when they vote on whether to accept or reject the proposed plan. Typically, the Bankruptcy Court will hold a hearing on the adequacy of the disclosure statement, which, if approved, permits the plan to be solicited.

Subchapter V dispenses with the disclosure statement requirement as an acknowledgment that a Subchapter V plan will be less complex, involves fewer parties, and moves quicker. Creditors and other parties in interest will then have an opportunity to assess the plan and determine whether it provides acceptable treatment.

Timing and Exclusivity in Filing a Subchapter V Plan

In a traditional Chapter 11 case, the debtor has an initial 120-day period, subject to extension, during which only it can file a plan.

Subchapter V does not allow other parties to file a plan, but it requires the debtor to file one within 90 days of the bankruptcy filing as part of the streamlined process, with only one narrow exception. However, there is no required timing for confirmation of the debtor’s plan, which can lead to placeholder plans being filed.

For more details on Subchapter V as it relates to retail bankruptcies specifically, check out Issues 14 and 15 of Bankruptcy Basics for Retail Landlords.

The Thought Leadership Committee of Barclay Damon’s Restructuring, Bankruptcy & Creditors’ Rights Practice Area issues alerts and blogs on an ongoing basis to keep clients, colleagues, and friends up to date on important developments in the insolvency space. If you have any questions regarding the content of this alert, please contact the author, Scott Fleischer, partner, at sfleischer@barclaydamon.com; Janice Grubin or Jeff Dove, Restructuring, Bankruptcy & Creditors’ Rights Practice Area co-chairs, at jgrubin@barclaydamon.com and jdove@barclaydamon.com; or Robert Wonneberger, Thought Leadership Committee chair, at rwonneberger@barclaydamon.com.