On March 21, 2025, the US Department of the Treasury, following up on its prior statement, issued an interim final rule narrowing the scope of the reporting requirements under Corporate Transparency Act (CTA).

Revised Applicability – Beneficial Owners and Foreign and Domestic Reporting Companies

Under the new rule:

- Domestic Reporting Companies—Corporate entities formed in the United States (e.g., a New York limited liability company or a Delaware corporation)—are now exempt from CTA compliance. They are not required to file beneficial ownership information (BOI) reports, update prior reports, or meet any upcoming CTA deadlines.

- Foreign Reporting Companies—entities formed outside the United States but registered to do business in the United States (e.g., a Canadian company authorized to operate in New York)—must still file BOI reports, limited by key exceptions:

- A Foreign Reporting Company that is entirely owned and controlled by US citizens does not need to comply with CTA deadlines or file BOI reports.

- US citizens who exercise substantial control over a Foreign Reporting Company (e.g., officers or executives) or own more than 25% of the entity (a Beneficial Owner) do not need to be included in the BOI reports.

- If a Foreign Reporting Company has any non-US citizen Beneficial Owners, it must file a BOI report for those individuals.

Examples Demonstrating Applicability

- Example 1: Adam and Brenda own a Canadian LLC registered to do business in New York. Adam, a Canadian citizen, owns 30% of the LLC, while Brenda, a US citizen, owns 70%. The LLC must file a BOI report, but only Adam must report his information as a Beneficial Owner.

- Example 2: Claire and Dan own a Swiss corporation registered to do business in Delaware. Claire, a Swiss citizen, serves as the corporation’s CFO, while Dan, a US citizen, owns 100% of the entity. The corporation must file a BOI report, but only Claire must report her information as a Beneficial Owner.

- Example 3: Ed and Fay own a Canadian LLC registered to do business in New York. Both Ed and Fay are US citizens, each owning 50%. Since the LLC is fully owned and controlled by US citizens, it does not need to file a BOI report and neither Ed nor Fay must report their information.

When Do I Need to File?

Foreign Reporting Companies registered to do business in the United States on or before March 21, 2025, must file an initial BOI report or update previously provided information by April 20, 2025.

Foreign Reporting Companies registered after March 21, 2025, must file an initial BOI report within 30 days of registration.

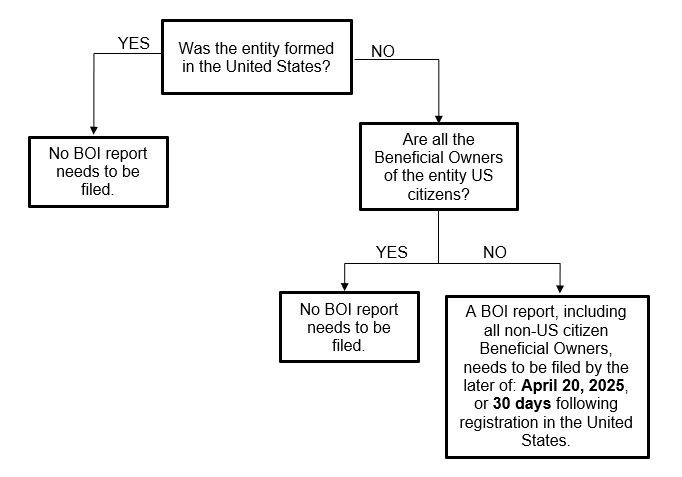

Do I Need to File?

Follow the chart below to determine your obligations under the CTA.

Attorneys at Barclay Damon will continue to monitor further guidance regarding the CTA and assist clients in navigating any questions.

If you have any questions regarding the content of this alert, please contact Danielle Katz, counsel, at dkatz@barclaydamon.com; Karina Shahine, associate, at kshahine@barclaydamon.com; or another member of the firm’s Corporate Practice Area.